Feb 02

20160

350.org / 1Sky, Foundations, Non-Profit Industrial Complex, Rockefeller Brothers Fund, Rockefeller Foundation

350.org Capitalism Ceres Divestment financialization of nature

AT A GLANCE: Why the Oligarchs Have United in Pushing the Divestment Campaign

The following is an excerpt from McKibben’s Divestment Tour – Brought to You by Wall Street [Part XIII of an Investigative Report] [The Increasing Vogue for Capitalist-Friendly Climate Discourse]

At a Glance:

- The economic models of the 20th century are now hitting the limits of what is possible

- Ecosystem services/payment for ecosystem services: assigning nature’s resources as monetary assets visible in national accounts and economic strategies is the key to growth in the twenty-first century

- The most vital pillar (of 3) as identified under “new economy” is the valuing and mainstreaming nature’s services (biodiversity) into national and international accounts

- Financial markets and business will be assigned as the new “stewards of ‘national natural capital”

- Global growth has become stagnant as identified by global institutions such as McKinsey: Can long-term global growth be saved? (January 2015, McKinsey and Company)

- The IMF and World Bank Group, identify a reduction in the growth of the global economy as a primary risk to the world. October 10, 2014

- The “greening of economies” as recognized by the UN, is not a reduction in global economic growth, rather, it is considered a new engine of growth.”

- Changing the capitalist system is not to be considered (Generation Investment)

- Financial markets and business, based on their role as stewards of ‘national natural capital’”

- The three key dates are 2015 (international agreement), 2020 (sustainable capitalism and ecosystem services accounting in place) and 2050 (the Earth’s ecosystems and biodiversity to be fully commodified)

- The mainstreaming of “sustainable capitalism” is to be in place by 2020 (Generation Investment)

- Economists have been “preparing to include a value for ‘natural capital’ in Britain’s GDP calculations by 2020”

- The ideologies/concept behind the commodification of the commons began in earnest at least 25 years ago and likely far earlier than that

- $60-70 trillion over the next decade-and-a-half is required for planned mega-infrastructure projects [Source]

- The biggest market is for carbon, with the world market growing from $11 billion in 2005 and being forecast to reach $3.1 trillion dollars in 2020, with $1 trillion of that value relating to the USA.

- A steady flow of new investment firms are expanding to exploit the emerging eco-systems market

- Financing (of renewable energy) must double by 2020 and double again to $1 trillion by 2030: the quadrupling investment from its current state is the stated goal

Metropolis, Germany, 1927. Directed by Fritz Lang. “In the year 2026, society in the great city of Metropolis is ruthlessly divided into two groups. The idle rich live in towers high in the sky, their playthings powered by great machines deep underground, where the workers live and toil….”

From Part XI: 2 Degrees of Credendum | In Summary, Divestment as symbolism:

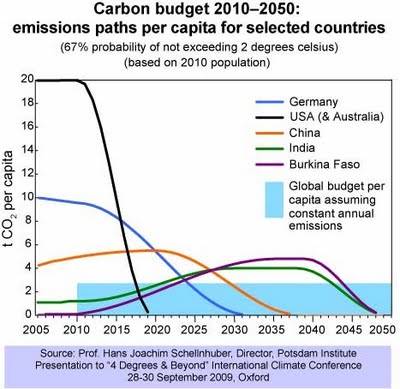

- The Do the Math tour, as the precursor to the global Divestment campaign, established and reinforced the false premise that the world retains a “carbon budget” that enables us to safely keep burning for decades to come

- Like 1Sky/350, the campaign is top-down, not grassroots up as presented. Not only has this global “movement” been sanctioned by the elites, it has been developed in consultation with Wall Street and financed from inception by the world’s most powerful oligarchs and institutions

- The campaign successfully invokes a certain naiveté and innocence due to the said premise (a moral divestment imperative) of the campaign

- It provides a moral alibi and evokes illusions of white saviour/moral superiority of those that divest/divest-invest while the very people divesting are those that comprise the 1% creating 50% of all global GHG emissions (anyone who can afford to board an airplane). Shuffling their investments does not change this fact or alleviate/absolve one’s role in accelerating climate change and ecological destruction

- Protesting fossil fuels cannot and will not have any effect on fossil fuel consumption, production or destruction without legitimately and radically addressing Annex 1 consumption, economic growth under the capitalist system, human population (specifically in Annex 1 nations), the military industrial complex and industrial factory farming

- The chosen campaign of divestment rather than the boycott of fossil fuels in combination with proposed sanctions on fossil fuel corporations demonstrates the insincerity of the campaign and its true intentions as sought (and developed) by its funders

- Divestment effectively constructs the moral acceptance of “green” consumption. The global divestment campaign confirms that the “market” can be and is the solution

- The campaign constructs and further reinforces the falsehood that there is no need to change either the economic system (beyond reforming capitalism) or dismantle the power structures that comprise it; nor is it necessary to address the underlying values, worldviews, classism, racism, colonialism and imperialism that are driving this physical and psychic

- It diverts attention away from the proliferation of private investments, hedge funds and privatization – key mechanisms in the “new economy.”

- It provides a critical discourse to divert attention away from the most critical issue of the 21st century: the commodification of the commons (in similar fashion to how the Stop the KeystoneXL! campaign was instrumental in enabling Buffett’s rail dynasty, only far more critical in significance)

- It builds on the 21st century corporate pathology “Who Cares Wins,” whereby “kindness is becoming the nation’s newest currency.” The pathology behind this intent is the corporate capture of “millennials” by manipulation via branding, advertising and social media

- Direct contact with “millennials” in colleges and universities around the world invokes pre-determined and pre-approved ideologies as sought after/controlled by hegemony while building loyalties: future NGO “members” / supporters, future “prosumers,” future “investors.”

- The campaign draws attention to the statistic that “just 90 companies caused two-thirds of man-made emissions” while making no mention that a mere 1% of people are creating 50% of all the global GHG emissions – the very people that comprise their target audience

- Although highlighting the fact that “just 90 companies caused two-thirds of man-made emissions” is critical, this information is being conveyed and utilized only to implement the financialization of nature

- The campaign stigmatizes fossil fuel investments which, by default, protect the 1% creating 50% of the global GHG emissions from similar stigmatization

- Success is measured by the number of institutions divesting-investing, and “shares/likes” on social media, ignoring the fact that divestment does nothing to reduce emissions as the world burns

- The divestment campaign presents a capitalist solution to climate change, presenting, repackaging and marketing the very problem as our new solution. Thus, the global power structures that oppress us are effectively and strategically insulated from potential outside threats

Clive Spash, 2008:

There is, of course, something contradictory in calculating a price for something you do not wish to trade. Perhaps realising this, one ecological advocate of ecosystems valuation has tried to claim that: ‘Valuing ecosystem services is not identical to commodifying them for trade in private markets.’ (Costanza, 2006: 749). That there is no commoditisation, or market-like exchange, implicit in ecosystem services valuation is plainly wrong. As the NRC report states: ‘The use of a dollar metric for quantifying values is based on the assumption that individuals are willing to trade the ecological service being valued for more of other goods and services represented by the metric (more dollars).’ This requires converting ecosystems functions into goods and services, and is clearly identical in approach to a model for trading commodities in a market. [Source]

Akin to those of privilege pretending their screen addicted children are actually gifted computer geniuses, such are the lies we tell ourselves in order to believe in a system whereby we “benefit” at the expense of others and the destruction of nature.