Jan 03

20200

Ford Foundation, Non-Profit Industrial Complex

#NaturalClimateSolutions (IUCN) Community Environmental Legal Defense Fund Conservation Industrial Complex Conservation International Debt-for-nature swaps Ecotrust Ford Foundation Global Alliance for the Rights of Nature's (GARN) Herman Daly International Union for the Conservation of Nature John Elkington Monetization of Nature Mumta Ito Natural Capital Natures-Rights.org New Economy Network Australia (NENA) People's Agreement of Cochabamba Rights of Nature Robert Costanza Spencer Beebe The Nature Conservancy World Bank

The Insane Nexus of “Natural Capital” & the Rights of Nature

January 3, 2020

By Michael Swifte

To my mind, the concepts the ‘rights of nature’ and ‘natural capital’ are counterposed. To me, Rights of Nature thinking supports the recognition of nature’s pricelessness, its intrinsic value, its interdependentness; whereas Natural Capital thinking supports, as Clive Spash says, “the commensuration of all values”.

Natural Capital proponents will always say that their concern is with conserving and protecting nature, but it is the process of ‘commensuration’ that transforms responsible stewardship into opportunities to exploit nature for profit. Nature is transformed from something of intrinsic value to be preserved and protected, to an asset class delivering ‘services’ for humans and great returns on investment.

Natural Capital and ecosystem services are the products of what Derrick Jensen in his 2015 ‘Open Letter to Reclaim Environmentalism‘ calls the “Conservation Industrial Complex”.

It is in the intersection of environmentalism and corporate conservation that I encountered the insanity of trying to engage simultaneously with two counterposed ideas.

3 Moments

I will outline 3 moments that left my head spinning. I will highlight moments when individuals and organisations that are deeply committed to Natural Capital thinking engage with individuals and organisations that are committed to promoting the intrinsic rights of mother nature. In these moments the fundamental contradictions between these 2 types of thinking did not become apparent to those involved. My concern is particularly with the absence of a contest of ideas. Surely those advocating for the Rights of Nature should be shouting out about the risks posed by further integrating our care for nature into the sphere of financial reckoning?

Context: Rights of Nature

In 2016 the Community Environmental Legal Defense Fund – International Center for the Rights of Nature prepared an historical timeline presenting key moments in the development of the Rights of Nature ‘movement’. While ideas were posited as far back as 1972, it wasn’t until the late 2000s that Rights of Nature were formally recognised under the provisions of local, state or national governments. Ecuador is the most often cited example having recognised the Rights of Nature in its constitution in 2008, but it wasn’t till 2010 that a collective voice was heard. [SOURCE]

In April 2010 the ‘People’s Agreement of Cochabamba’ presented an historic formulation and assertion of The Rights of Mother Nature:

In an interdependent system in which human beings are only one component, it is not possible to recognise rights only to the human part without provoking an imbalance in the system as a whole. To guarantee human rights and to restore harmony with nature, it is necessary to effectively recognize and apply the rights of Mother Earth. [SOURCE]

Rights of Nature as a position of environmental advocacy has been carried forward over the last decade by various organisations including the Community Environmental Legal Defense Fund, Australian Earth Laws Alliance and Mumta Ito’s Natures-Rights.org.

Context: Natural Capital

Natural Capital thinking finds its roots in the merging of economics and ecology that was started at the 1982 Wallenberg Symposium in Sweden which was themed ‘Integrating Ecology and Economics’. In attendance at the Wallenberg Symposium was before a brief stint with the World Bank where he advocated for “rights to pollute” within his ‘steady state’ framework. In 1997 Costanza had the dubious honour of being the first person to present a Natural Capital valuation of the whole earth’s “biosphere” at somewhere between US$16-54 trillion per year.

In her 2007 obituary of Ecological Economics co-founder AnnMari Jansson for the International Society for Ecological Economics newsletter, Karin E. Limburg highlights the “chasm” between ecology and economics at the first Wallenberg Symposium:

Several days of intensive meetings brought home the philosophical chasm between these disciplines, but also made it clear that there was some common ground to be nurtured. [SOURCE]

All the most wealthy conservation organisations on the planet support Natural Capital thinking through various means; WWF, The Nature Conservancy, and Conservation International being prime among them. Collectively these organisations who are deeply engaged with corporations and governments, and in possession of unprecedented access to land and resources in the global south are represented by the International Union for the Conservation of Nature (IUCN).

Nature or Natural Capital is viewed by the Conservation Industrial Complex, embodied by the IUCN, as a “stock”, “producing value for people”. Under a policy motion prepared for the IUCN for the World Conservation Congress 2020 in Marseille the IUCN envisage their role as sustainable managers of nature to deliver “goods and services”. [SOURCE]

Mumta Ito, Global Alliance for the Rights of Nature and the International Union for the Conservation of Nature

It’s hard to know what became of the Global Alliance for the Rights of Nature’s (GARN) efforts to get the IUCN to operationalise recognition of the Rights of Nature. The trail goes cold in 2017 after an event hosted by Nature’s Rights in the European Parliament in Brussels. [SOURCE]

Between 2012 when the first Rights of Nature resolution was presented at the IUCN World Congress, and 2017 when the IUCN Global Programme 2017-2020 came into action, Rights of Nature advocates led by Mumta Ito put in significant efforts imploring the IUCN member organisations to incorporate nature’s rights in “all its initiatives”.

Between 2012 and now many IUCN member organisations have accelerated their efforts to push forward with the ‘natural capital approach’. The Natural Capital Coalition was formed in 2012 and the Natural Capital Protocol was launched in 2016.

Here is a quote from Conservation International CEO Peter Seligmann upon the launch of the Natural Capital Protocol:

The urgency of addressing climate change requires innovations across all sectors of society. This is why Conservation International strongly supports the innovations of the Natural Capital Protocol. Their breakthrough methodology provides Businesses with the tools to understand their dependency on nature and their impact on nature. This is essential if they want to achieve sustainability. It is a challenge that enlightened business leaders should undertake for their bottom line, as well as for the interest of humanity and the preservation of the benefits we all receive from nature: fresh air, clean water and food production. [SOURCE]

2012

The Global Alliance for the Rights of Nature (GARN) asked for nothing less than a deep commitment from IUCN member organisations. Here’s a selection from the resolution presented to the IUCN at the 2012 World Conservation Congress:

RECALLING that the Peoples’ World Conference on Climate Change and the Rights of Mother Earth held in Cochabamba, Bolivia, in April 2010, resulted in a Universal Declaration of the Rights of Mother Earth, announced and supported by indigenous peoples and social movements, who, as representatives of an active civil society call on their governments and the United Nations to include this topic in key debates such as those on climate change and biodiversity; [SOURCE]

2016

At the IUCN World Conservation Congress in 2016 the Global Alliance for the Rights of Nature again asserted the need for a deep commitment from the IUCN.

We ask for your support in urging the IUCN to implement its 2012 Resolution on nature’s rights. WCC-2012-Res-100, “Incorporation of the Rights of Nature as the organizational focal point in IUCN’s decision making,” calls on the IUCN to adopt a Declaration of the Rights of Nature and incorporate nature’s rights into all its initiatives. Help us ensure the IUCN makes implementation of this Resolution a key action item in its 2017-2020 work program. [SOURCE]

In a TedXFindhorn talk in 2016 Mumta Ito argued for the implementation of the Rights of Nature “in law”. My concern is that her argument that implementing Rights of Nature is a “counterbalance to corporate rights” puts the cart before the horse. Corporate rights are being advanced through Natural Capital projects supported by the IUCN and its member organisations. GARN and Mumta Ito have implored the IUCN and its members to operationalise the Rights of Nature while the architecture supporting Natural Capital has rapidly expanded.

Rights of Nature proponents do not challenge Natural Capital thinking in their advocacy. Rights of Nature cannot act as a counterbalance against corporate rights unless it is operationalised. Merely promoting Rights of Nature without at least attending to the possible threats posed by Natural Capital thinking does nothing to contest the appropriateness of measuring and managing nature into the sphere of financial interests rather than into the interests of priceless nature. If Natural Capital thinking can coexist or supplement the operationalisation of the Rights of Nature then Mumta Ito and GARN ought to be on record somewhere making that case. The reality is that Natural Capital thinking, and the projects initiated and supported by IUCN members like The Nature Conservancy, WWF and Conservation International are barely given any consideration by Rights of Nature advocates.

Here I’ve transcribed a quote from Mumta Ito’s TedXFindhorn talk:

Establishing rights of nature in law is the first step to moving us to a holistic paradigm of ecological governance, and it’s also a very powerful counterbalance to corporate rights. It’s a game changer.[SOURCE]

The response by the French representatives to the inclusion of “the rights of nature” in the IUCN Programme 2017–2020 makes clear that no additional Rights of Nature have been conferred.

France supports the IUCN Programme 2017–2020. Concerning the inclusion of “the rights of nature” in Programme Area 2 (Objectives 14 and 15), France interprets the terminology used in the Programme as creating no additional rights to those that France recognises in its national legislation and within the framework of the United Nations.[SOURCE]

The ‘IUCN Programme 2017-2020 Draft 2’ suggests that the IUCN will spread the word about the Rights of Nature. The text of the only reference to the “rights of nature” in the 2017-20 programme suggests that Rights of Nature will be used to inform certain approaches to conservation, but it does not suggest anything like operationalisation. Aiming to “secure” Rights of Nature is not the same as adopting the ‘Declaration of the Rights of Nature’.

IUCN also aims to secure the rights of nature and the vulnerable parts of society through strengthening governance and the rights-based approach to conservation. Knowledge is disseminated widely and is taken up widely by the Union itself, the international system, governments, the donor community, the business sector, individual scientists and practitioners. [SOURCE]

2017

In March of 2017 Nature’s Rights held an event at the European Parliament in Brussels titled ‘Nature’s Rights Conference: The Missing Piece of the Puzzle’. This event seems to be the last hurrah for the Rights of Nature.

I keep coming back to this particular moment in my research and I wonder where the battle went from here. I suspect Rights of Nature have been disintegrated into the “rights-based approach” referred to in the 2017-2020 programme.

Luc Bas, Director, IUCN European Regional Office was non-committal in his response to pressure to support a Universal Declaration of the Rights of Nature:

Being a science-based and evidence-based organisation, IUCN will continue to explore and evaluate the benefits of such an initiative, [SOURCE]

2020

The IUCN have 128 motions listed for their 2020 World Conservation Congress. None contain any reference to the “rights of nature”. [SOURCE]

Here is a quote from ‘IUCN World Conservation Congress 2020 – Motion 062: Towards a Policy on Natural Capital’.

Natural capital is defined in these Principles as the stock of natural ecosystems on Earth including air, water, land, soil, biodiversity and geological resources. This stock underpins our economy and society by producing value for people, both directly and indirectly. Goods and services provided to humans by sustainably managed natural capital include a range of social and environmental benefits including clean air and water, climate change mitigation and adaptation, food, energy, places to live, materials for products, recreation and protection from hazards. [SOURCE]

Robert Costanza and NENA 2017

Robert Costanza was one of the guests at the New Economy Network Australia (NENA) annual conference 2017. NENA was founded and is directed by the founder and convenor of Australian Earth laws Alliance (AELA), Dr Michelle Maloney. AELA are the most active proponents of Rights of Nature in Australia having partnered with Community Environmental Legal Defense Fund (CELDF) on a 2018 campaign for Rights of the Great Barrier Reef. [SOURCE]

Costanza sits on the Earth Economics – Advisory Group along with Herman Daly, Annie Leonard (Greenpeace USA) and former Gund Institute colleague Joshua Farley. The Gund Institute are members of the New Economy Coalition and played a leadership role in the development of the Natural Capital Approach that is at the heart of the Natural Capital Project which is a partnership between The Nature Conservancy, WWF, and Stanford University. The Natural Capital Approach is defined here with crucial input from Natural Capital Project partners and the Gund Institute:

A means for identifying and quantifying the natural environment and associated ecosystem services leading to better decision-making for managing, preserving and restoring natural environments. [SOURCE]

I sat outside The Edge conference hall in Brisbane as Robert Costanza presented to the New Economy Network Australia conference in 2017. I tweeted furiously to the conference hash-tags while Costanza offered his 1997 valuation of the earth’s biosphere. I received zero replies.

I cannot comprehend how the conference organiser Dr Michelle Maloney reconciled herself with the imperatives and networks behind Natural Capital thinking while trying to promote Rights of Nature thinking.

You can view Costanza’s slide presentation here:

‘The Reforms Needed to Build an Ecological Economy‘

Community Environmental Legal Defense Fund, Deep Green Resistance and Spencer Beebe

“After a century as a hub for the goods of the industrial economy, our building has become a focal point for a new economy in which “Natural Capital” — the flow of goods and services from nature — is our measure of prosperity and resilience.” “The 70,000-square-foot Natural Capital Center also houses Ecotrust’s headquarters and a mix of nonprofit and business tenants gathered around the themes of ecological forestry and fisheries, green building, technology and financial investment. Patagonia, the outdoor clothing company known for its environmental ethic, is our retail anchor, working in its largest retail outlet anywhere.”

Image: [Source] [Source] [Source]

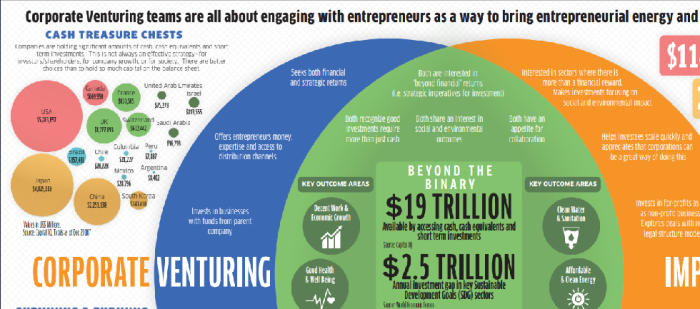

When the Community Legal Defense Fund and Deep Green Resistance lawsuit against the State of Colorado was summarily dismissed in October 2017 I started to look at the environmental organisations that engage Natural Capital thinking in regard to the Colorado River Basin. I found that Earth Economics had completed an assessment of “nature’s value” in the Colorado River Basin in 2014. The identified/key stakeholders in the Colorado River Basin were utilities and irrigation companies. Here is a quote from ‘Nature’s Value in the Colorado River Basin’:

Based on the ecosystem services examined and treated like an asset with a lifespan of 100 years, the Colorado River Basin has an asset value between $1.8 trillion and $12.1 trillion at a 4.125 percent discount rate. [SOURCE]

When I looked at the staff and advisory board membership of CELDF I found connections to both Derrick Jensen’s ‘Open Letter to Reclaim Environmentalism’, and the Conservation Industrial Complex. I also wondered how it was possible that DGR and CELDF did not give consideration to environmental organisations that employ Natural Capital thinking in the Colorado River Basin. Surely a key component of the risk assessment for a significant law suit would include consideration of the economic stakeholders in the Colorado River Basin?

Thomas Linzey is the founder and senior legal counsel of CELDF as well as a signatory to Jensen’s open letter. On the advisory board with Jensen is Spencer Beebe, the founder of Ecotrust. It is Beebe’s career in the Conservation Industrial Complex that I will unpack here.

Beebe could be said to be the embodiment of the Conservation Industrial Complex. He spent 14 years working with The Nature Conservancy before becoming the founding president of Conservation International.

He developed the Ecotrust headquarters in Portland with a 2 million loan from the Ford Foundation and named it the ‘Natural Capital Center’.

our building has become a focal point for a new economy in which “Natural Capital” — the flow of goods and services from nature — is our measure of prosperity and resilience [SOURCE]

Ecotrust clearly treat nature as an asset class, a set of ecosystem services to be valued, data captured, and capital to be managed. A biography written by Aaron Reuben in 2014 outlines the engagement of the financial sector in the work of Ecotrust:

Early on, Ecotrust partnered with ShoreBank to form a community development bank, ShoreBank Pacific (now Beneficial State Bank), to support small and natural resource-based businesses with sustainability goals, including fishing, farming and redevelopment enterprises. Beneficial State now manages $500 million in sustainability-minded assets across the Pacific Northwest. Ecotrust also started the world’s first forest ecosystem investment fund, with the goal of generating profits for investors through the sale of forest products, like timber, and ecosystem services, like wildlife habitat and carbon sequestration. In all, according to the organization, Ecotrust has “converted $30 million in grants into more than $1 billion in capital assets at work for local people, businesses, and organizations from Alaska to California.” [SOURCE]

In 2016 Ecotrust partnered with Earth Economics on a ‘Pure Water Partnership’ with Eugene Water and Electric Board (EWEB) who have dams and power stations on the McKenzie River.

The following quote is from a news item titled ‘Eugene’s Incentive Based Approach to Protecting Water Supply’ posted to the Earth Economics website in November 2016:

The work has involved partnership with other key organizations – Ecotrust, our primary partner, provided all of the GIS mapping and biophysical data, including collecting shade and carbon data.

Early in 2017 the utility EWEB announced that it was beginning a rehabilitation and modernisation project. It’s clear to see that the utility was the primary beneficiary of Ecotrust’s work in collaboration with Earth Economics.

The Eugene Water & Electric Board (EWEB) announced beginning March 27, and continuing for the next five years, it will begin a US$100 million rehabilitation and modernization project at its 114-MW Carmen-Smith hydroelectric facility along the upper McKenzie River, about 70 miles east of Eugene, Ore. [SOURCE]

Long term plans for the McKenzie River are to be led by the utility. Here are 2 quotes from a document titled ‘McKenzie River Sub-basin Strategic Action Plan for Aquatic and Riparian Conservation and Restoration, 2016-2026’:

McKenzie Collaborative: This group was formed in 2012 to develop new programs that protect water quality and protect and restore habitat. The Voluntary Incentives Program (VIP) and the McKenzie Watershed Stewardship Group are products of the Collaborative. Member organizations are CPRCD, Earth Economics, Ecotrust, EWEB, LCOG, MRT, MWC, MWMC, OSU, The Freshwater Trust (TFT), UO, USFS, and UWSWCD. The group is led by EWEB and meets monthly on the second Friday.

Ecosystem Valuation and the Economic Benefits of Source Protection EWEB recognizes that the McKenzie Watershed is an extremely valuable asset. Although the natural services that it provides are not financially accounted for in traditional economic models, new methods are being developed attempt to place value on this ‘natural capital.’ In 2010, EWEB hired Earth Economics to conduct a watershed valuation, which estimated the annual value of McKenzie Watershed ecosystem services at between $248 million to $2.4 billion. Services include things such as water supply, flood mitigation, soil erosion control and many other ecosystem services. [SOURCE]

No Contest

The proponents of the Rights of Nature are failing to contest the greatest threat to the achieving their objectives. The integration of the measurement and the management of nature and natural resources, and watersheds and carbon sinks into our existing systems of corporate finance continues unabated. Promoting the Rights of Nature through entreaties to collective bodies and legal actions against governments does not necessarily function as a challenge to Natural Capital thinking. Former Managing Director at JP Morgan and Capital Institute founder John Fullerton has integrated Natural Capital thinking in his ‘regenerative capitalism’ concept. John Elkington, B Corporation boss and corporate responsibility ‘leader’ has a new book coming out called ‘Green Swans: The Coming Boom In Regenerative Capitalism’. The commensuration of all values is taking place at speed under the #NaturalClimateSolutions hash-tag underwritten by the leading lights of the Conservation Industrial Complex. Proponents of the Rights of Nature need to take account of the language of ‘assets’, ‘investments’ and ‘services’ used by the proponents of Natural Capital thinking and their clients. Rights of Nature proponents need to name the problem and contest the ideas presented by those individuals and entities who are promoting dangerous and counterposed thinking. The Rights of Nature is a revolutionary demand requiring a clear and uncompromising response. Natural Capital thinking only offers capitalist reform which only ever leads to business as usual.

Notes:

*The following notes provide some background to the work of Conservation International in its first year of operation under the leadership of Spencer Beebe and Peter Seligmann. Debt-for-nature swaps were a vital tool for the penetration of conservation organisations into the developing world and establishing the groundwork for the implementation of Natural Capital thinking.

1.‘Eco Rover: It’s Hard to Pin Down Spencer Beebe’ By Aaron Reuben

1987, in search of a more nimble organization, he and fellow Yale alum Peter Seligmann co-founded Conservation International (CI) to pursue the same goal, global biodiversity conservation, through more innovative means. (One of CI’s first actions was to complete the world’s first “debt for nature swap,” buying foreign debt from Bolivia in exchange for the creation of a three million acre nature reserve).

https://environment.yale.edu/news/article/eco-rover-its-hard-to-pin-down-spencer-beebe/

2.‘Tropical Rain Forests: Bolivia’

In 1987 Conservation International initiated the first “debt-for-nature” swap when it purchased $650,000 worth of Bolivian debt for only $100,000.

https://rainforests.mongabay.com/20bolivia.htm

3.‘A Challenge to Conservationists’ By Mac Chapin

*It took Conservation International 1 year to engineer the world’s first debt for nature swap.

Conservation International began in dramatic fashion in 1986. During the previous several years, TNC’s international program had grown rapidly, and tension with its other programs had mounted. When TNC’s central management tried to rein it in, virtually the entire international staff bolted and transformed itself into CI. From the start, the new organization was well equipped with staff, contacts, and money it had assembled before-hand. In 1989, it brought in yet another group of defectors—this time from WWF—and began expanding with the help of an aggressive fundraising machine that has become the envy of all of its competitors. However, a substantial portion of its funding comes from just four organizations: the Gordon & Betty MooreFoundation, the MacArthur Foundation, the World Bank, and the Global Environment Facility (GEF).

https://redd-monitor.org/wp-content/uploads/2019/03/WorldWatch-Chapin.pdf

4.‘Profiles of Impact: Swapping Debt for Nature in Bolivia’ By Maria Rodriguez

In 1987 — the year that both Conservation International (CI) and Vanguard Communications were founded — CI undertook the first-ever “debt-for-nature” swap between Citicorp and the government of Bolivia. Vanguard publicized the groundbreaking deal, wherein CI purchased a portion of Bolivia’s foreign debt in exchange for the protection and management of nearly 3.7 million acres in the Beni Biosphere Reserve.

[]Conservation International is also turning 30 this year, and now employs more than 1,000 people and works with more than 2,000 partners in 30 countries. Vanguard President Maria Rodriguez caught up with CI’s CEO, Peter Seligmann, to discuss how this groundbreaking deal paved the way for CI and the work it does today.

- What’s your best memory of that July day back in 1987 when you announced the first debt-for-nature swap?

“A couple of things stand out. First, it was so powerful to demonstrate that foreign debt accrued by countries impacted the health of tropical forests and there was a way to solve that problem. We were able to do something truly worthy that impacted the ultimate health and well-being of a nation.

“Second, the announcement was essentially the coming-out party for Conservation International, since we’d just opened our doors at the end of January of that same year. What an impactful way to gain attention for our mission to link conservation of nature with finance and economics. Through the incredible media attention garnered by the debt-for-nature swap, we illustrated that solutions to environmental problems have to be sensitive to the livelihoods of people.”

https://www.vancomm.com/2017/02/01/swapping-debt-nature-bolivia/

5.’Overview of Debt for Nature Swaps and Description of the Structure of Debt for Nature Swaps’ By Romas Garbaliauskas

Why do NGOs like Conservation International, the Nature Conservancy, KEHATI, and WWF participate? There is a cost here. We pay 20% of the debt forgiveness. One is that, invariably, we always work in the countries where we participate in these debts for nature swaps. I believe that has always been the case. It would be hard to understand why an NGO would participate in a debt swap for a country where they are not working. We get to basically help establish conservation priorities.

6.‘New impact investment instrument aims to restore degraded cloud forests and improve energy security in Latin America’

“Cloud forests are among the most water-productive of any tropical forest ecosystem, are uniquely biodiverse and deliver a multitude of clear benefits, but finance for conserving and restoring forests has fallen short of the need,” said Justus Raepple, Conservation Finance Lead for TNC’s Global Water division. “There aren’t many connections in nature like this, where the benefits are so profound to a single beneficiary that the restoration actions can potentially pay for themselves.”

“Restoring cloud forests helps hydropower operators reduce significant sedimentation management costs, and also prolongs the life of the plants, so it avoids having to build more dams, or finding the energy in less environmentally friendly ways,” explained Romas Garbaliauskas, Senior Director of Conservation Finance at Conservation International.

7.‘Hydropower threatens Bolivian indigenous groups and national park’ by Eduardo Franco Berton/RAI

Torewa in the Tsimané (also called Chimane) language means “place of enchantment.” This is a community of 46 indigenous families, located in an area of 300 hectares within the forests of the Integrated Management Natural Area and Madidi National Park. Combined, the natural area and the park cover nearly 1.9 million hectares. Torewa is one of 17 communities that could potentially be affected by the construction of two dams planned in the El Bala and El Beu canyons on the Beni River.

https://news.mongabay.com/2016/10/hydropower-threatens-bolivian-indigenous-groups-and-national-park/

8.‘Bolivia announces plans to develop hydropower in Grande River basin’

In October 2018, HydroWorld reported that Bolivian energy authorities were in the process of identifying about US$2 billion in financing for early stage hydro and wind power generation projects. This included Rositas.

9.‘Bolivia’s ENDE awards contract to Chinese firms for Rositas hydroelectric plant’

The deal comes with an initial US$1 billion in financing from the Export-Import Bank of China and will see China Three Gorges Corp. and China International Water & Electric engineer and construct what is expected to be a 500 MW to 600 MW project.

[Michael Swifte is an Australian activist and a member of the Wrong Kind of Green critical thinking collective.]